Why Do Mortgage Lenders Need Bank Statements & What Are They Looking For?

When you’re trying to get onto the property ladder, there’s an immense amount of documentation you’ll need to prepare and provide to mortgage lenders – bank statements being one of the most crucial to the underwriting process.

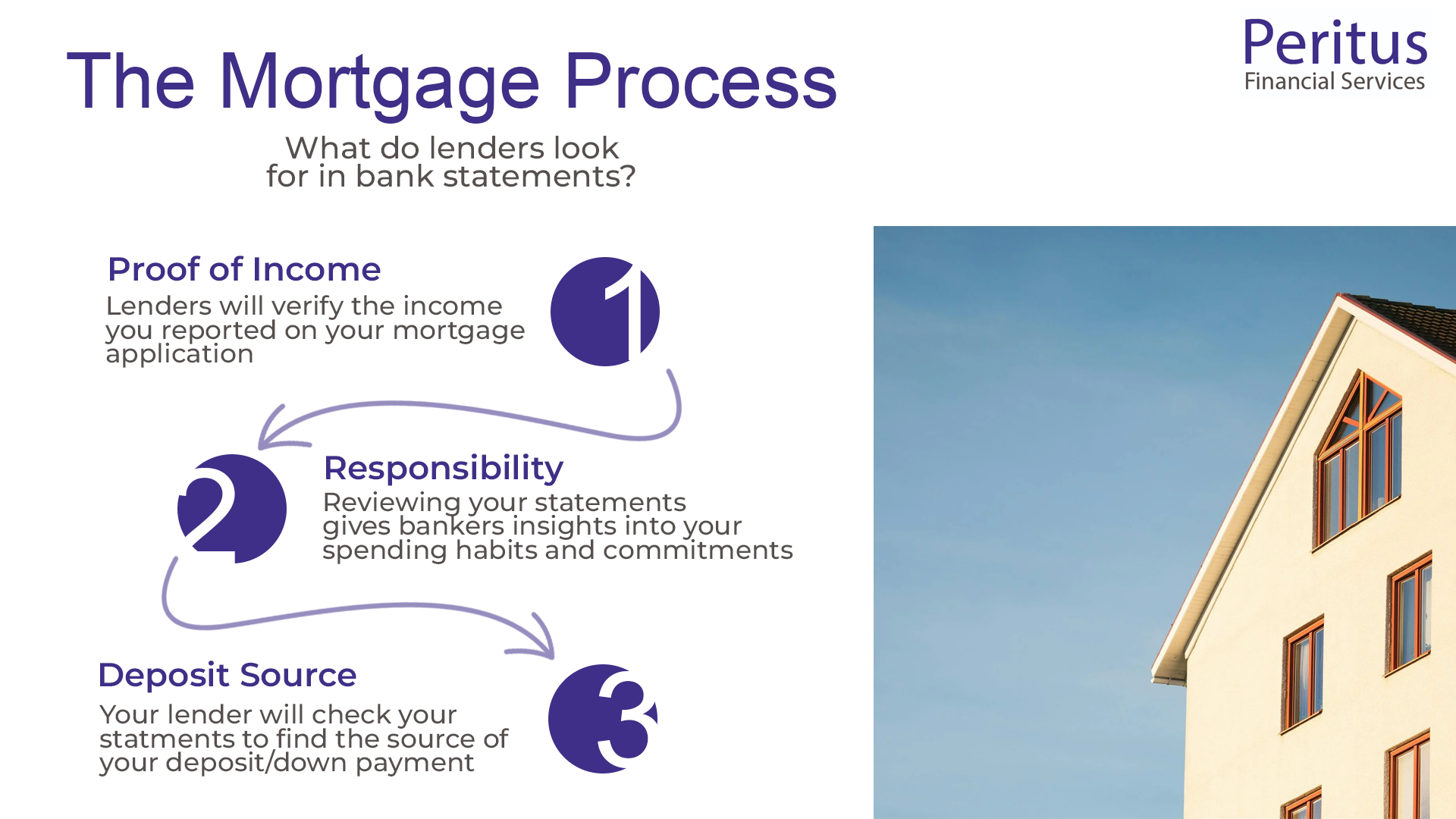

Bank statements are there to provide what is essentially your financial biography, and give insight into your spending habits, income streams, and financial responsibility. Mortgage lenders need this kind of information in order to verify things like your employment, confirm you have consistent income, and feel assured that you can manage your finances well.

It may seem like this is a little bit of an invasion of privacy, but handing over your bank statements to lenders is 100% necessary! Mortgage lenders have an obligation to ensure that the risk they undertake with each loan is calculated and justified and by meticulously reviewing your bank statements, they aim to safeguard against the potential of you defaulting on payments.

But that does give rise to a very pertinent question. One which we’ve been asked on many occasions when helping first time buyers and home movers: exactly what are lenders looking for on bank statements? In this article, we’re going to better explain not only why do mortgage lenders check bank statements as part of an application, but also what they’ll be looking for when deciding whether or not to approve an application.

Why Do Mortgage Lenders Need Bank Statements?

Lenders Want To Assess Financial Responsibility

Lenders go through your bank statements with a fine tooth comb, not because they’re nosy, but because they need to be able to gauge how capable you are at being responsible with your money.

They’ll look at things like how regular and stable your income is and how consistent you are at meeting your existing financial commitments. This evaluation isn’t really just about the numbers though, the idea is that it helps lenders paint a picture of your financial behaviour over time. Do you save consistently? Are your spending habits sustainable? Lenders answer these questions with the information your bank statements provide them.

Your Bank Statements Demonstrate How Trustworthy You Are To Lenders

Beyond just looking at spending habits, lenders will use the information they get from your bank statements to see how reliable you are. They’ll want to see that you live within your means and have a buffer or some savings put aside to manage unexpected expenses, with things like this you signal to lenders that you’re a lower risk.

This trust extends to the lender the belief that you will continue to manage your finances wisely throughout the term of the mortgage. It’s about building a case for yourself as a borrower who not only can meet their current obligations but is also likely to maintain this capacity in the future.

How To Get Your Bank Statements

However, for those who use online and mobile banking, this is going to be the fastest and easiest way to get a copy of their latest statements. You can log into your online banking platform and download your statements in PDF format. Once downloaded, you have the option to either keep them digital or print them out. Take a look at this guide on how to do this with most banking apps and websites if you’re still unsure.

What Are Lenders Looking For On Bank Statements?

- Good Financial Habits. At the top of the list, lenders look for evidence of sound financial management. They’ll be looking for regular income being paid by your employer, your savings and how much they are, and payments that meet your outgoing expenses each month on time.

- Income Verification. Lenders use your bank statements to verify the income you’ve declared on your application matches in reality. Having consistent income across several months is what assures them you are financially stable.

- Expenditure. Lenders will want to see your spending habits and make sure that they’re justified. Having controlled and reasonable spending suggests that you live within your means and are likely to be a reliable borrower.

- Cash Reserves/Savings. Seeing whether or not you have a safety net in place that you can use to cover unexpected expenses (rather than having to borrow) shows that you’re again, less of a risk.

Red Flags On Your Bank Statements For Lenders

Whilst lenders will be wanting to see all of the positive signals we’ve mentioned above, there are also plenty of red flags they’ll look out for too. Whilst you may have ticked some or all of the boxes above, certain activities and transaction patterns can raise red flags, affecting your mortgage application’s outcome. Here’s a rundown of what might concern a lender and the impact these red flags could have on your application.

- Frequent Overdraft Use. Consistently dipping into your overdraft suggests to lenders that you struggle to manage your monthly expenses within your income. This can raise doubts about your ability to keep up with mortgage repayments.

- Missed Payments & Late Fees. Late payments on loans, credit cards, or bills indicate that you may not consistently meet financial obligations. This can affect your credit score, making lenders hesitant to offer you a mortgage.

- Unexplained Large Deposits. Sudden, large increases in your account balance without a clear explanation may prompt lenders to question their origin. It could be that the deposits are from cash-in-hand work which is often a red flag as it can’t always be properly accounted for. Also, there could be concerns that these deposits could be loans, affecting your debt-to-income ratio.

- Use of Payday Loans. The appearance of payday loan transactions on your bank statements can be a significant red flag. Using these kinds of credit options often suggests you are or have been recently in financial distress as well as signalling poor financial planning, given that these loans often come with high interest rates and are considered a last resort.

- Frequent PayPal Transactions. Whilst using PayPal regularly isn’t likely to cause you any problems with your mortgage applications, a high volume of PayPal transactions can sometimes be scrutinised. Lenders might view this as an indication of undisclosed, potentially risky financial activity.

- Evidence of Excessive Gambling. Regular transactions to gambling platforms are a significant concern for lenders. While the odd small-stake flutter on the horses or the football might not be an issue, frequent or large bets suggest risky financial behaviour.

- Payments for Luxury Items. Any regular payments for items that are expensive and not essential will raise questions on your spending priorities. Lenders may interpret this as irresponsible financial management or a tendency towards impulsive spending, overshadowing your ability to save or manage funds prudently.

How To Make Sure You Show Lenders You’re Reliable

To convey your reliability to lenders, start by scrutinising your spending habits. Reducing unnecessary expenditures, such as dining out or indulging in luxury purchases, can not only help you savage money, but will also help persuade lenders that you don’t splash the cash recklessly.

It’s also a good idea not to go changing jobs at this time if you can avoid it. Lenders value a consistent income stream from your employer as it suggests you’ll always have that money available to meet your mortgage repayments.

With any debt that you currently have and are paying off, you should consider making large down payments (where possible) on any high-interest obligations to improve your debt-to-income ratio. It’s equally important to resist the temptation of taking on new debts, which could adversely affect your credit score.

Making sure that you practise other responsible financial behaviours, including avoiding gambling activities that might reflect negatively on your bank statements and ensuring all bills are paid promptly is going to make sure you paint yourself in a favourable light to lenders. Not only this, but you’ll also probably find that being more responsible and taking a break from the bookies is going to have a very positive impact on your mental health too!

Get Help From A Professional Mortgage Advisor

Now that you’ve read through why mortgage lenders need to look at your bank statements and what it is that they’re looking for, you should be able to see that it’s not simply about the formalities of handing over documents. Lenders want to use your bank statements as a reflection of your financial behaviour, showcasing your ability to manage finances responsibly and indicating your reliability as a borrower.

But handing over bank statements is still such a small part of the mortgage application process, and there are so many other complexities that can be difficult to traverse (especially if you’re a first time buyer).

So why not choose to get the help of an independent finance and mortgage broker like Peritus Financial. Our expertise lies in guiding you through the complexities of finance, ensuring that with our assistance, you have the best possible chance of a successful mortgage application.

Whether you’re a first-time buyer or looking to move up the property ladder, the journey towards securing your dream home can be made smoother with our expert advice.

Get in touch with us today either by calling on 01134 696 410 or by email at info@peritusfinancialservices.co.uk.